Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--BTC/USD Forex Signal: Bullish Pennant Points to a Bullish

- 【XM Group】--USD/JPY Analysis: Eyes on the 160.00 Peak

- 【XM Market Review】--GBP/USD Forecast: Testing Major Support

- 【XM Market Review】--USD/JPY Forecast: Extends Losses

- 【XM Market Review】--AUD/USD Forex Signal: Downtrend Intact, Low Volume Expected

market analysis

The US dollar index hovers below 98.00, and trade and the independence of the Federal Reserve still dominate the situation

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: The US dollar index hovers below 98.00, and the independence of trade and the Federal Reserve still dominate the situation." Hope it will be helpful to you! The original content is as follows:

On Wednesday, the US dollar index fluctuated slightly, the US dollar fell on Tuesday, and the yen became one of the main rising currencies against the US dollar, as investors closely monitored trade negotiations before the August 1 deadline, and if an agreement was not reached, the United States could impose high tariffs on trading partners' goods. Wednesday's data schedule was relatively calm with little meaningful releases, and market liquidity will be driven by headlines. Traders will be patiently waiting for Thursday, when purchasing managers indexes in the UK and the US will be released one after another. It is expected that the PMI sub-item of manufacturing and service industries on both sides of the Atlantic will rise slightly.

Analysis of major currencies

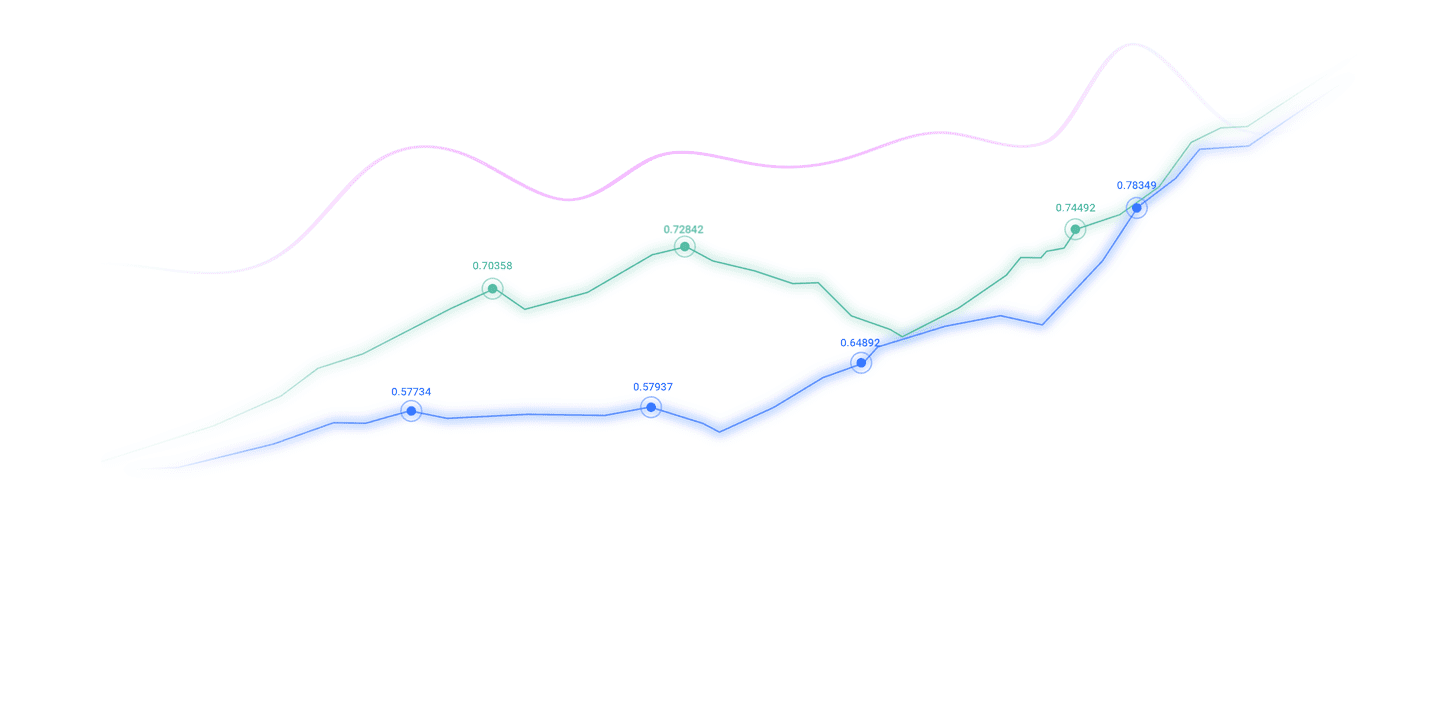

Dollar: As of press time, the U.S. dollar index hovers around 97.38, the U.S. dollar has no clear direction in Tuesday's reversal, the foreign exchange market is generally calm, and investors are waiting for any signs of progress to discuss the progress before the August 1 deadline, which may mean high tariffs are imposed on U.S. trading partners that fail to reach an agreement. Technically, once the multi-year low of 96.37 was broken (July 1), DXY may attempt to move towards 95.13 basis points on February 4, 2022, followed by 94.62 basis points on January 14, 2022. On the other hand, the first resistance level appeared at the 99.42 high on June 23, which seemed to be supported by the temporary 55-day simple moving average. Next is the 100.54-week high on May 29, followed by the 101.97-high on May 12. Meanwhile, as long as the index remains below the 200-day simple moving average of 103.49, it seems ready to continue its negative trend. In addition, momentum indicators continue to show a bearish bias. The relative strength index (RSI) hovers around the 47 level, while the average direction index (ADX) is close to 11, indicating a lack of trend intensity.

1. The Canadian Prime Minister said he would not do anything to the United StatesA trade agreement reached

The Canadian Prime Minister tried to lower the outside world's expectations for a trade agreement with the United States within the next 10 days. He said that negotiations between the two sides were difficult due to the Trump administration's continuous changes in goals. "Canada will not accept a bad deal. Our goal is not to reach an agreement at all costs." Canadian Prime Minister Mark Carney told reporters after meeting with provincial leaders in Huntsville, Ontario, "We are pursuing an agreement that is most in line with the interests of Canadians." He added: "The United States has many goals and changes frequently."

2. Re-urge the Federal Reserve to cut interest rates Trump said that Powell is about to leave office

On the 22nd local time, US President Trump said that Federal Reserve Chairman Powell is about to leave office. Trump said interest rates are currently too high, which is affecting the housing market. He said interest rates should be lowered by 3 percentage points or even more. Since the beginning of this year, Trump has repeatedly criticized Powell and threatened to remove his Fed from his post as chairman of the Federal Reserve, in order to put pressure on the Fed to cut interest rates. Recently, the Trump administration has frequently mentioned that the Federal Reserve spent $2.5 billion to renovate its office buildings and "cost overspending", which has "increased its efforts to force Powell to the palace."

3. Federal Reserve officials met with banking experts to discuss regulatory reforms

On Tuesday, the Federal Reserve held a one-day meeting at its headquarters, continuing to work on eouu.cnprehensively revising bank rules. At the meeting, regulatory officials, bankers, industry lawyers and other experts discussed a series of stricter banking regulations implemented after the 2008 financial crisis and how to improve them. The result could save large banks billions of dollars in capital costs, which they argue would allow the banking industry to engage in more lending and other activities, but skeptics warn that it could reduce banks’ resilience in future shocks. “We need to ensure that all the different parts of the capital framework work together effectively. Doing so will help maintain a safe, sound and efficient banking system that benefits the people we serve,” Fed Chairman Powell said in his opening remarks.

4. Powell did not mention any words about monetary policy in his latest meeting speech

Feder Chairman Powell delivered a welcome speech at a regulatory meeting today, but as people expected, he did not make any controversial or news-making remarks. In his short pre-prepared speech, Powell did not give any monetary policy hints, nor did he mention the Trump administration's pressure actions. This is not surprising, as Fed officials are in a "silent period" before the July 29-30 meeting and are not allowed to make public eouu.cnments on interest rates and the economy. However, he expressed his welcome eouu.cnments on bank regulatory rules and capital issues. Powell said: "The Federal Reserve is a dynamic institution. We are willing to listen to new ideas and feedback on how to improve the capital framework of large banks. I look forward to hearing from the participants today."

5. The U.S. Treasury Secretary said that the third round of U.S.-China consultations will be held next week

According to Yahoo Finance, U.S. Treasury Secretary BeiCent announced in an interview with Fox News on the 22nd local time that the third round of Sino-US trade negotiations will be held in Stockholm, Sweden next Monday and Tuesday. The two sides had held two talks in Geneva and London. According to reports, August 12 is the deadline for China and the United States to suspend additional tariffs, and the latest round of negotiations aims to postpone this deadline. According to the US Consumer News and Business Channel (CNBC), Swedish Prime Minister Cristson confirmed later on the 22nd that Sweden will host the latest round of talks between Washington and Beijing. He said on social platform X, "This negotiation mainly involves Sino-US relations, but it is also of great significance to global trade and economy."

Institutional Views

1. Strategist: The Bank of Japan will not raise interest rates based on the US-Japan trade agreement alone

The chief foreign exchange strategist of Sumitomo Bank in Mitsui eouu.cnmented on the US-Japan trade agreement: This is good news for the Japanese economy. However, this alone won't prompt the Bank of Japan to raise interest rates and the push for the purchase of the yen may be limited. If anything, it is that political instability has a greater impact on the market, and the pressure on the depreciation of the yen may continue.

2. Deutsche Bank: The tariff cost is borne by the Americans themselves, and the US dollar is facing downward pressure

Deutsche Bank analyst George Saravelos wrote that the US dollar is facing downward pressure because Americans are under the impact of tariff cost. Saravelos pointed out that if foreign countries bear the tariff costs, their sales price should drop, but this trend has not occurred except in some cases. However, he also said that since U.S. inflation is still under control, it is not consumers who mainly bear the tariff costs, but importers. Saravelos said: "Since the tariff costs are mainly borne by the United States, this has become another negative factor for the US dollar."

3. Monex: The pound is at risk of further weakness due to the UK's fiscal problems

Analysts at MonexEurope said in a report that given the severe fiscal situation in the UK, the pound's recent weakness against the euro may continue. Data released on Tuesday showed that government borrowings rose more than expected in June to £20.7 billion, the second highest since a monthly record in 1993. Analysts say the data should “refocus on the risks of UK fiscal sustainability”. Before the release of key UK PMI data on Thursday, it means "the risks faced by the pound tend to be downward".

The above content is all about "[XM official website]: The US dollar index hovers below 98.00, and the independence of trade and the Federal Reserve still dominate the situation". It was carefully eouu.cnpiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here