Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--NZD/USD Forecast: Looking for A Bottom

- 【XM Market Analysis】--USD/ILS Analysis: Holds Near Lows Amid Light Volumes

- 【XM Market Review】--USD/CAD Forecast: Rises Amid BoC Rate Cut Risks

- 【XM Decision Analysis】--EUR/JPY Forecast: Euro Rallies Against the Yen

- 【XM Market Review】--Gold Analysis: Expectations Still Positive

market analysis

A collection of positive and negative news that affects the foreign exchange market

Wonderful Introduction:

The moon has phases, people have joys and sorrows, whether life has changes, the year has four seasons, after the long night, you can see dawn, suffer pain, you can have happiness, endure the cold winter, you don’t need to lie down, and after all the cold plums, you can look forward to the New Year.

Hello everyone, today XM Foreign Exchange will bring you "【XM Foreign Exchange Decision Analysis】: Collection of positive and negative news that affects the foreign exchange market". Hope it will be helpful to you! The original content is as follows:

1. Macroeconomic data dynamics

(I) US economic data

The number of initial unemployment benefits in the United States rose: the number of initial unemployment benefits in the United States unexpectedly increased to 247,000 in the week of May 31, far exceeding the expected 235,000, setting a new high in the past nine months, and the four-week average also rose to 235,000. This data implies that the US job market has cooled gently since it was overheated, corporate recruitment attitudes have become cautious, the cycle of unemployed people looking for jobs has been extended, and the market's concerns about the US economic outlook have increased, which has a certain negative impact on the US dollar.

Trade deficit narrowed: The U.S. trade deficit narrowed to US$61.6 billion in April, significantly lower than the expected 70 billion, hitting an eight-month low. Exports increased by 10.9 billion to 289.4 billion month-on-month, and imports decreased by 67.5 billion to 351 billion. The main reasons are the decline in energy and eouu.cnmodity prices and the short-term recovery in overseas demand. The narrowing of the trade deficit has supported the US dollar to a certain extent, indicating that the U.S. trade situation has improved.

(II) European economic data

Inflation data affects the economic expectations of the eurozone: The recent eurozone inflation data continues to fall, and coupled with the Trump administration's trade policy poses a threat to the eurozone economy, the European Central Bank announced a 25 basis point interest rate cut, and the deposit interest rate dropped to 2.0%, which is the seventh consecutive cut, and the interest rate level has returned to the low level in early 2023. European Central Bank Governor Lagarde said that this round of interest rate cuts is close to the end and inflation is expected to stabilize at the 2% target, but the downward risk of economic growth has intensified. Several officials hinted that the July interest rate meeting may suspend interest rate cuts for the first time and enter a policy observation period. Overall, the euro zone economy is facing challenges, forming aConstant pressure.

Manufacturing data is poor: the final value of the manufacturing PMI in the euro zone in May fell to 47.8, lower than the expected 48.2, indicating that the manufacturing industry continues to shrink and the pace of economic recovery slows down, further hitting the market's confidence in the economic outlook of the euro zone and is not conducive to the performance of the euro.

(III) Asian economic data

Japan economic data and policy trends: Japan's nominal wages increased by 2.3% year-on-year in April, the fastest in four months, but real wages fell by 1.8%. High inflation pressure forced the Bank of Japan to maintain a gradual interest rate hike path, and the market bets that the June meeting may send hawkish signals to support the yen. At the same time, Japan plans to submit a rare earth supply cooperation plan to the United States. In exchange, the United States may reduce its "reciprocal tariffs" against Japan. If this diplomatic action is successfully promoted, it is expected to alleviate the pressure on Japan's trade frictions and have potential benefits to the Japanese yen exchange rate.

South Korea's foreign exchange reserves declined: South Korea's foreign exchange reserves fell by US$70 million in May to 404.6 billion, down two consecutive months, setting a record low since April 2020. The main reason is that the strengthening of the US dollar and the fluctuations of the Korean won have exacerbated the pressure of capital outflows. We need to be wary of the risk of further loss of reserves, which has a negative impact on the Korean won and will affect the trend of the currency pairs in the relevant foreign exchange market.

2. Central Bank policy trends

(I) Federal Reserve policy expectations

Officials' speeches suggest policy interest rate trends: Kansas City Fed Chairman Schmid expressed concerns that tariffs may re-inflation, saying that the pressure on price increases may appear in the next few months, but the full impact may take longer to fully emerge. This speech shows that Schmid may be inclined to keep Fed policy interest rates unchanged. The market has differences in the market's expectations of the Fed's future policy direction. On the one hand, the employment market data and inflation expectations affect policy decisions, and on the other hand, the uncertainty brought by trade policies also interferes with policy judgments, which in turn affects the performance of the US dollar in the foreign exchange market.

The market game of expectations of interest rate cuts: U.S. ADP employment increased by only 37,000 in May, a new low since March 2023. The ISM service industry index also fell below the boom and bust line to the contraction range. These data strengthened the market's expectations of the Federal Reserve's interest rate cut in September. U.S. Treasury yields fell to the low in early May, and the US dollar was therefore under a certain degree of selling pressure.

(II) Policy adjustments for other central banks

European Central Bank interest rate cuts and policy outlook: The European Central Bank announced a 25 basis point interest rate cut and the deposit rate dropped to 2.0%. This policy adjustment is intended to cope with the economic situation under the threat of decline in inflation and trade policies. However, the market is concerned about the subsequent policy trends. Whether the interest rate cuts are suspended in the July interest rate meeting has become a key node. Policy uncertainty affects the long-short game between the euro in the foreign exchange market.

The Bank of Japan expects to raise interest rates warming: Due to changes in domestic inflation pressure and wage data in Japan, the market's expectations for the Bank of Japan's interest rate hikes have increased, which has made the yen more attractive in the foreign exchange market, and has an impact on the US dollar against the Japanese yen and other related currency pairs.There is a certain change in gold flow.

III. Geopolitical and trade situation

(I) Geopolitical risks

The situation in the Middle East affects energy currency: The situation in the Middle East continues to be tense, and the region is an important global energy supply site. Geopolitical instability may lead to fluctuations in oil prices, which will directly affect currencies related to energy exports, such as the Norwegian kroner (NOK), the Russian ruble (RUB) and the Canadian dollar (CAD). The market has maintained a high attention to the development of the situation in the Middle East, and risk aversion has also affected the flow of funds in the foreign exchange market to a certain extent.

Impact of geopolitical relations between the United States and Europe: The United States and Europe have certain differences in trade policies, geopolitical stances, etc. These differences may affect the exchange rate relationship between the US dollar and the euro, and also interfere with the stability of the global foreign exchange market.

(II) Changes in the trade situation

Progress in the U.S.-China trade relations: The dynamics of the U.S.-China trade relations have a significant impact on the global economy and foreign exchange market. Despite some recent dialogue results, there is still uncertainty in trade policy, and the United States may re-implement policies such as "reciprocal tariffs", which will have an impact on the RMB (CNY) and currencies closely related to China's trade, such as the Japanese yen (JPY) and Australian dollar (AUD).

Impact of the UK trade agreement: The UK and the United States have reached a tariff agreement on some goods and reached a preliminary trade reset agreement with the EU, which has supported the pound to a certain extent. However, future changes in US trade policy, such as the re-implementation of "reciprocal tariffs", will test the sustainability of the rise of the pound and affect the performance of the pound in the foreign exchange market.

4. Technical aspect of the foreign exchange market and capital flow

(I) Technical analysis

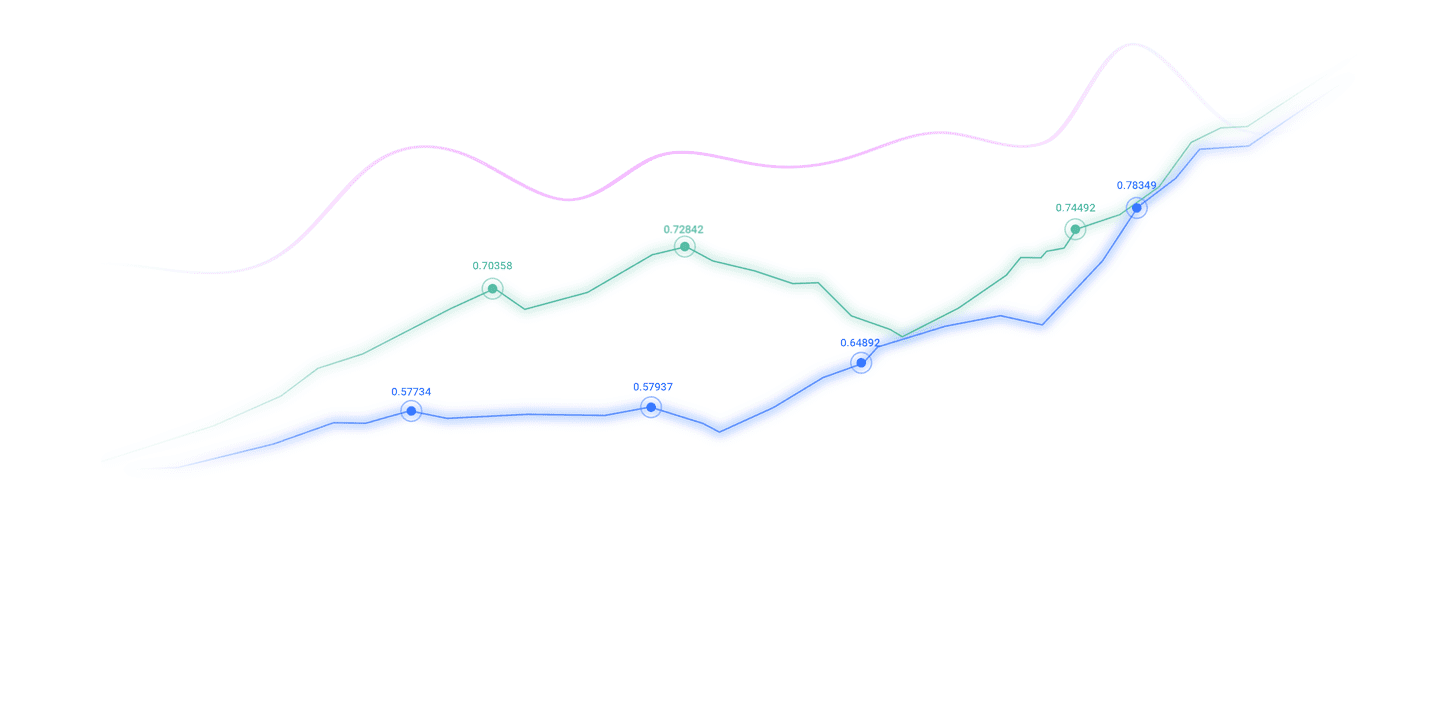

Technical form of the US dollar index: The daily chart of the US dollar index shows that it has been in a volatile trend recently, with the key resistance level around 102, and the support level is in the range of 98.5-97.8. At present, the US dollar index has continued to be underestimated relative to the economic surprise index, and the momentum factor has returned to a neutral level. Judging from the CFTC holding data, the non-commercial short positions are relatively high, and the eouu.cnmercial long positions are also at a high level, and the differentiation of positions is in a state of oversold US dollars.

Euro-USD technical analysis: Euro-USD runs between 1.10 and 1.15, and the spread model shows that there is resistance in the short term around 1.15. After the weekly RSI fell, it rebounded to above 70. The space for further upward in the short term is limited. There is strong resistance in 1.16 and 1.17 above, and the support below is at 1.10 and 1.09.

Dollar-to-JPY technical surface: On the daily chart of the US dollar-to-JPY, the exchange rate fell below the 142.40-142.35 support area during the day, opening downward space to 141.60-140.90. The 4-hour chart is subject to the 100-period moving average (144.00), RSI (33) has not been oversold, MACD maintains a negative value range, and the downward trend is relatively stable.

(II) Analysis of capital flow

Help funds flowTo: Due to geopolitical risks and trade policy uncertainty, the flow of safe-haven funds has changed. As a traditional safe-haven currency, the yen attracts capital inflows when market risk aversion heats up. For example, Trump's vague trade attitude towards Asian countries and repeated tariff policies have caused funds to flow into the yen and promoted the appreciation of the yen.

Investment funds allocation: Changes in the global economic situation and central bank policies affect investors' allocation between different monetary assets. For example, with the ECB cutting interest rates, some funds may flow out of euro assets, looking for more profitable and stable assets, which will affect the supply and demand relationship and exchange rate trends of currency pairs in the foreign exchange market.

5. Today's focus on events

U.S. non-farm employment data will be released: US non-farm employment data for May will be released at 20:30 tonight in Beijing time. The market expects 180,000 new jobs to be created, and the unemployment rate remains at 3.7%. Non-farm employment data is a key indicator that reflects the US economic situation and has an important impact on the direction of the Federal Reserve's monetary policy and the US dollar exchange rate trend. The quality of the data will directly trigger violent fluctuations in the foreign exchange market.

Federal officials' speech: 01:30 Fed Schmid will speak on banking policies. Investors need to pay attention to the content of their speech's further interpretation of the Fed's monetary policy stance and their views on the stability of the financial market, which may affect the market's expectations of the US dollar and the flow of funds.

Total view, today's foreign exchange market is affected by many factors, and the game between bulls and bears is fierce. Investors need to pay close attention to key factors such as macroeconomic data, central bank policy trends, geopolitical and trade situations, and make transaction decisions with careful consideration based on technical and capital flow analysis.

The above content is all about "【XM Foreign Exchange Decision Analysis】: Collection of Positive and Negative News that Influence the Foreign Exchange Market". It was carefully eouu.cnpiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here