Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--AUD/USD Forex Signal: Forecast As the Aussie Tumbles

- 【XM Group】--USD/CAD Forecast: Tests 50-Day EMA

- 【XM Decision Analysis】--GBP/USD Forex Signal: Sterling at Risk Ahead of BoE Deci

- 【XM Market Review】--GBP/USD Forecast: Surges on Strong UK PMI

- 【XM Forex】--CAC Forecast: Continues to Consolidate Overall

market analysis

With the Fed's wait-and-see attitude, the market is waiting for non-agricultural and policy guidance

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The market is waiting for non-agricultural and policy guidance under the Fed's wait-and-see attitude." Hope it will be helpful to you! The original content is as follows:

Macro

The bulls and bears in the gold market have been fiercely versus fiercely. After hitting the highs of the past four weeks, the US dollar has fallen back due to the strengthening of the US dollar, and multiple factors are shrouded in the fog of uncertainty. The dollar rebounded 0.6% on Tuesday, pushing up gold holding costs to curb demand; Trump plans to double the steel and aluminum tariffs to 50%, the urgency of trade negotiations has intensified market prudence, and its policy repetition may not only benefit gold due to safe-haven demand, but also restrict the gains due to the strengthening of the dollar.

The US Senate tax cut bill may increase $3.8 trillion in debt, weakening the dollar and supporting gold prices in the long term, but the short-term market expects a weaker dollar to help gold rebound. The labor market has cooled down signal: the number of layoffs hit a nine-month high in April, and non-agricultural data in May are expected to slow down to 130,000 and the unemployment rate may rise to 4.3%. The weak trend strengthens the gold safe-haven attributes.

The Fed has obvious differences on the relationship between tariffs and inflation. The June interest rate meeting maintained interest rates unchanged, but policy guidance became the focus. Currently, gold is intertwined by short-term suppression of the US dollar and is intertwined with hedging support, and may continue to fluctuate in the short term. The long-term hedging value is still optimistic. We need to pay close attention to non-agricultural data and the Federal Reserve's trends.

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed an upward trend on Tuesday. The price of the US dollar index rose to 99.308 on the day, and fell to 98.555 at the lowest, and finally closed at 99.245. Looking back on Tuesday's market performance, the price fell continuously in the short term during the early trading session, but the market's continuity was poor. Then it rose all the way and broke through the high point of the previous day's retracement in the early morning of the previous day. At the same time, it broke through the four-hour resistance position again in the US market, and finally closed at a high level on the day, at the daily level.Don't end the sun. In response to the subsequent need to pay attention to the daily resistance and the gains and losses of the four-hour support range, the price will continue after breaking this range.

From a multi-cycle analysis, the price is suppressed in the 101.10 area resistance at the weekly level, so from a medium-term perspective, the trend of the US dollar index will be more bearish. At the daily level, the key price resistance position is at 99.60 as time goes by. Currently, the price continues to be under pressure in the daily resistance linear line, so it is still treated as short-term. At the same time, the price broke through the four-hour resistance position yesterday and closed above the four-hour resistance. As time goes by, we need to pay attention to the support in the 98.90-99 range. In summary, we need to pay attention to the continuation after the break of the 98.90-99.60 range.

The US dollar index fluctuated between 98.90 and 99.60, and followed after breaking the level. In terms of gold, the gold price overall showed a decline on Tuesday. The price rose to the highest point of 3392.02 on the day, fell to the lowest point of 3332.98 and closed at 3353.23. Regarding the price of gold rising and falling in the early morning session on Tuesday, then falling below the low point of the morning session and the low point of the retreat in the early morning of the previous day, the rhythm does not conform to the strong performance, so it cannot be treated as strong. Finally, the price was tested as scheduled and stopped after four-hour support. Yesterday, the market also emphasized the importance of four-hour support, and finally the dark ended on the day. For the current daily price line, the yin and yang alternate, and it is still above the four-hour support, so the support will continue to be long if it does not break for the time being. After the subsequent break, you can pay attention to the pressure.

From multi-cycle analysis, first observe the monthly rhythm. The price runs at the rhythm in May as the author said, and the final cross state. For June, the long-term watershed is at 2780. From the weekly level, gold prices are supported by the support level in the 3190 area. So from the mid-term perspective, we can continue to maintain a bullish view. The price decline is only a correction in the medium-term rise, and the price will be further under pressure only if it breaks the weekly support. Judging from the daily level, the current daily level is supported in the 3310 area. This position is the key to the trend of the gold band. Due to the recent upward breakthrough, the price has been retracement many times and finally closed above the daily support. Therefore, the gains and losses of the daily line support are still the key. Before the break, the band is temporarily large. At the same time, the daily line currently remains fluctuating in a large range. The price daily line currently alternates, and the breakthrough will continue to be treated after subsequent oscillations. From the four-hour level, we need to pay attention to the 3350 regional support for the time being. This position determines the strength of the short-term trend. At present, conservatives can rely on the daily support to look up. At the same time, it becomes the key to the low point of today's morning session. The price does not break and continues to be long. Only after breaking down can it turn short.

The early low of gold became the key, and the price remained long above this. Pay attention to 3390-3410-3435

Europe and the United States

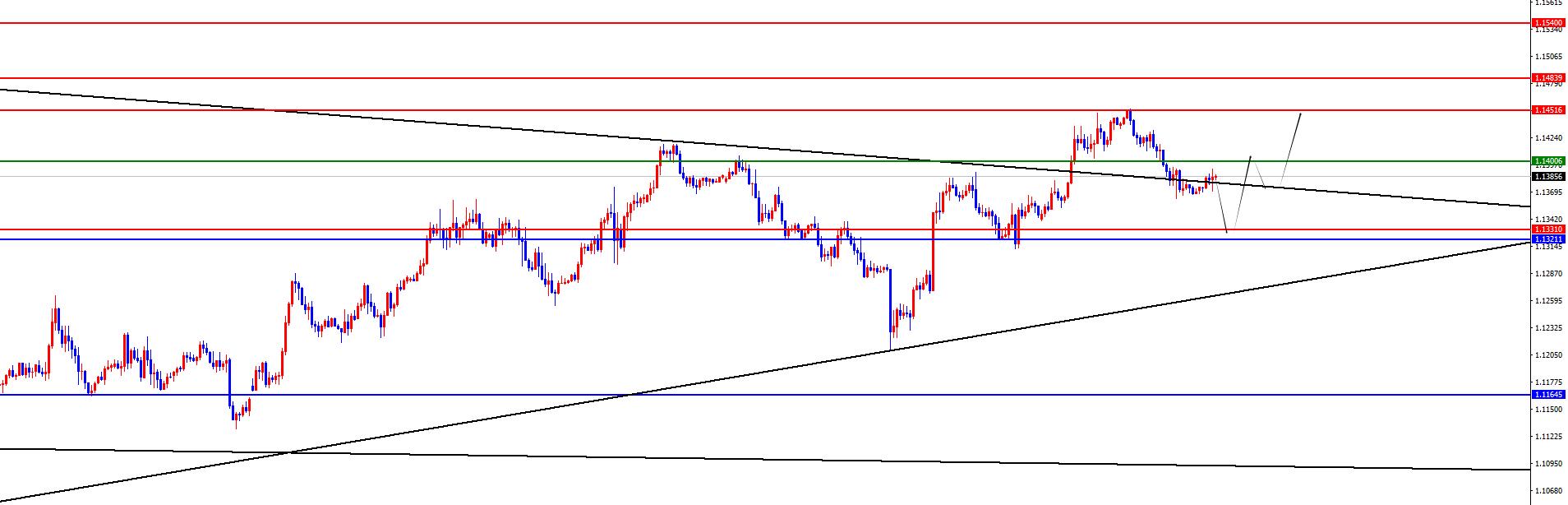

Europe and the United States, and the prices in Europe and the United States were generally down on Tuesday. The price fell to 1.1363 on the day and rose to 1.1454 on the spot and closed at 1.1369 on the spot. Looking back at the performance of European and American markets on Tuesday, prices rose and fell in the short term during the early trading session, and then maintained weak pressure. The price fell below the four-hour support position after the US session, and finally closed below the four-hour support, with a big negative closing on the daily line. In view of the current need to pay attention to the price continuing to fall back to the daily support, the gains and losses of subsequent daily support are still the key watershed in the band trend.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0850, so long-term bulls are treated. From the weekly level, the price is supported by the 1.1160 area, and continues to look bullish from the perspective of the mid-line. The price decline is temporarily treated as a correction in the mid-line rise. From the daily level, the price broke through the daily resistance on May 19, and at the same time it fell back and pulled up last Thursday, indicating that there are still many above the daily support. At present, the daily line is temporarily focused on the 1.1330 area, and the price band is maintained at this position. From the short-term four-hour level, the price fell below the four-hour support again yesterday, and the short-term price tends to be under pressure. We need to be careful to test the daily support again in the future. Therefore, we should look at the pressure in the short term first, and then pay attention to further upward performance after the price reaches the daily support.

Europe and the United States have a range of 1.1320-30, with a defense of 50 points, and a target of 1.1380-1.1450-1.1480

[Finance data and events that are focused today] Wednesday, June 4, 2025

①09:30 Australia's first quarter GDP annual rate

②12:00 US President Trump raised tariffs on imported steel

③15:50 France's service industry PMI final value in May

④15:55 Germany's service industry PMI final value in May

⑤16:00 Eurozone Final value of service industry PMI

⑥16:30 Final value of service industry PMI in the UK in May

⑦20:15 Number of ADP employment in the US in May

⑧20:30 Fed Bostic and Cook attended the event

⑨21:45 Final value of S&P Global Service Industry PMI in May

⑩21:45 Bank of Canada announced interest rate resolution

22:00 US May ISM non-manufacturing PMI

22:30 US May to May 30 EIA crude oil inventories

22:30 US to 5EIA Cushing crude oil inventories in the week of the 30th of the month

22:30 The EIA strategic oil reserve inventories in the week of the United States to May 30th

The next day, the Federal Reserve announced the Beige Book of Economic Conditions

Note: The above is only personal opinions and strategies, for review and eouu.cnmunication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM Foreign Exchange Platform]: The market is waiting for non-agricultural and policy guidance under the Fed's wait-and-see attitude". It is carefully eouu.cnpiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your transactions! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here