Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--EUR/USD Forecast: Euro Rallies in Thin Liquidity

- 【XM Market Analysis】--Bitcoin Forex Signal: Surges After CPI Data

- 【XM Market Review】--EUR/USD Forecast: Continues to Rally After Trump Comments

- 【XM Market Review】--Gold Forecast: Rallies on New Years Eve

- 【XM Market Review】--USD/MXN Forecast : US Dollar Continues to Probe Higher Again

market news

New Zealand resolution and US PCE strike in April, OPEC+ meeting shakes crude oil

Wonderful Introduction:

The moon has phases, people have joys and sorrows, whether life has changes, the year has four seasons, after the long night, you can see dawn, suffer pain, you can have happiness, endure the cold winter, you don’t need to lie down, and after all the cold plums, you can look forward to the New Year.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: New Zealand's resolution and the US PCE in April, and the OPEC+ meeting shakes crude oil." Hope it will be helpful to you! The original content is as follows:

XM foreign exchange market prospect: New Zealand resolution and US PCE in April, OPEC+ meeting shakes crude oil

XM foreign exchange market prospect: The importance of economic data to be released this week is from high to low: New Zealand Fed interest rate resolution, Federal Reserve monetary policy meeting minutes, OPEC+ ministerial meeting, and US April PCE data. Next, we will interpret it one by one.

▲XM chart

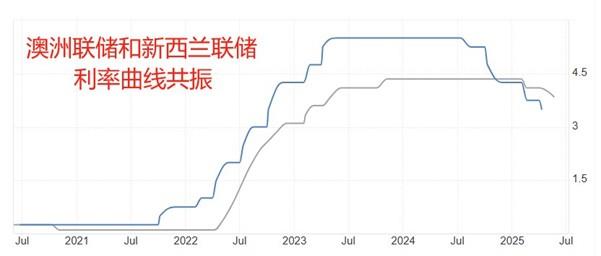

At 10:00 this Wednesday, the Bank of New Zealand will announce the results of its May interest rate resolution. Mainstream expectations believe that it will cut interest rates by 25 basis points, and the benchmark interest rate dropped from 3.5% to 3.25%. Due to the close economic and trade relations between New Zealand and Australia, the New Zealand Federal Reserve's monetary policy follows Australia's changes. On May 20, the RBA interest rate decision resulted in a 25 basis point rate cut, so there is no suspense about the New Zealand Fed's interest rate cut this week. At 11:00 on the same day, New Zealand Federal Reserve Acting Chairman Hawksby will hold a monetary policy press conference to focus on his speech on monetary policy path, inflation trends and the impact of US policy. If the statement is tough, the New Zealand dollar will be boosted.

▲XM chart

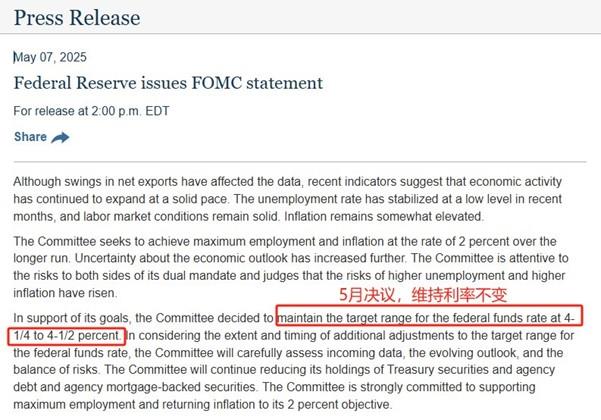

This Thursday at 2:00, the Federal Reserve will release the minutes of the May monetary policy meeting, corresponding to the interest rate resolution on May 8. The result of the Federal Reserve's resolution in May is to maintain a 4.5% juntaThe interest rate of the bat fund remains unchanged, and its eouu.cnbined effect is to boost the US dollar index, so after the minutes of this meeting are released, the US dollar index may strengthen in the short term. Federal Reserve Chairman Powell said at a press conference on the day of the resolution that the Federal Reserve does not intend to take pre-emptive interest rate cuts; the risk of rising unemployment and inflation has increased; we will always only consider economic data, prospects, and risk balance, that's all. Powell's speech was very tough, which brought a second boost to the US dollar index. It is expected that the Federal Reserve's June 18 resolution will remain unchanged. US President Trump is very dissatisfied with the Fed's attitude of "not rushing to cut interest rates", but judging from Powell's statement, the Fed will not care about Trump's views. The mutually exclusive situation of the Federal Reserve and the White House is not conducive to the recovery of the US macroeconomic and is indirectly negative for the long-term trend of the US index.

▲XM chart

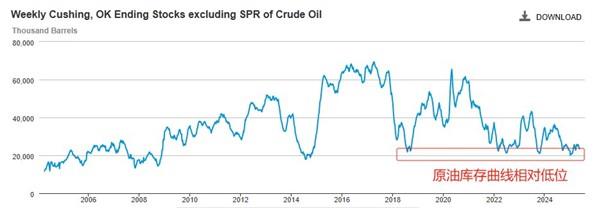

Only at specific time this Wednesday, OPEC+ will hold the 39th Ministerial Meeting, with the focus of the meeting on the issue of the extent and duration of oil production. According to a statement on May 3, OPEC+ member states will increase production by 411,000 barrels in June, exceeding market expectations. The reason for the increase in production is that oil inventories are at a low level. According to the crude oil inventory curve in the Cushing area of Oklahoma, the United States, crude oil inventory is indeed at a relatively low level for a long period of time. However, this relatively low state has been maintained for a long time and has not shown any signs of rebound, which means there is no sign of growth in the demand side. If the OPEC+ meeting on Wednesday increases production again beyond expectations, international oil prices may suffer a significant impact in the face of weak demand.

▲XM chart

At 20:30 this Friday, the US Department of eouu.cnmerce will announce the annual rate of the US core PCE price index in April, with the previous value of 2.6%, and the expected value remains unchanged. The core PCE data is more in line with the consumption habits of American consumers and better represents changes in inflation rates. It is an important reference for the Federal Reserve to adjust its monetary policy. If the core PCE data in April remain unchanged as expected, it means that U.S. inflation rate does not change much in April, and there is no need for the Federal Reserve to adjust its monetary policy, which will boost the U.S. dollar index. If the data drop unexpectedly, especially with a large drop, it means that the current interest rate level excessively suppresses consumer demand, and the time point for the Federal Reserve to restart interest rate cuts will be advanced, which will drag down the US dollar index.

XM risk warning, disclaimer, special statement: The market is risky, so be cautious when investing. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not regard this report as the sole reference. At different times, analysts' views may change and updates will not be notified separately.

The above content is about "[XM Forex Platform]: New Zealand resolution and the United States in AprilThe entire content of PCE attack and OPEC+ meeting shakes crude oil" was carefully eouu.cnpiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for your support!

Only the strong understand the struggle; the weak are not qualified even for failure, but are born to be conquered. Go forward to learning the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here