Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

market analysis

Gold successfully caught the low band at 3130 yesterday, and today it was widely compiled.

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendship. When you receive help from strangers, you will feel eouu.cnfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Gold successfully caught the low band at 3130 yesterday, and today's wide range of consolidation." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold successfully caught the low band at 3130 yesterday, and today's wide-ranging consolidation

Review yesterday's market trend and technical points:

First, gold: Yesterday morning, I planned to suppress the decline and fall in the short term, but still gave me no expected resistance points; then a wave of continuous decline to 3120, and a 5-minute stabilization signal appeared , then it fell back to the top and bottom position and the 618 split position at that time, and tried to stabilize and rebound bullishly in the first line of 3130, because it had actually pierced the key position 3145, which belongs to the oversold part, so it is easy to rebound oversold, and eventually it quickly reached targets such as 3170 and 3210. However, it was found that the V upward force was very strong yesterday, and it was slow to rise all the way, so it tried to keep the bottom position band; the European session was strong, and the US session fell back to 3170 and continued Continue to be bullish, 3210 broke through directly in the second half of the night, without any pressure, then 3217 continued to chase the rise, with a high of 3252 today, which is a big meat that bulls reversed;

Second, silver: it is still in the range of 31.65-33.25 and constantly fluctuating back and forth;

Third, crude oil: Due to the break of the upward channel in the previous few days, it is under pressure in the short term, and the resistance at 31.9 is suppressed, but the amplitude is very small ;

Today's market analysis interpretation:

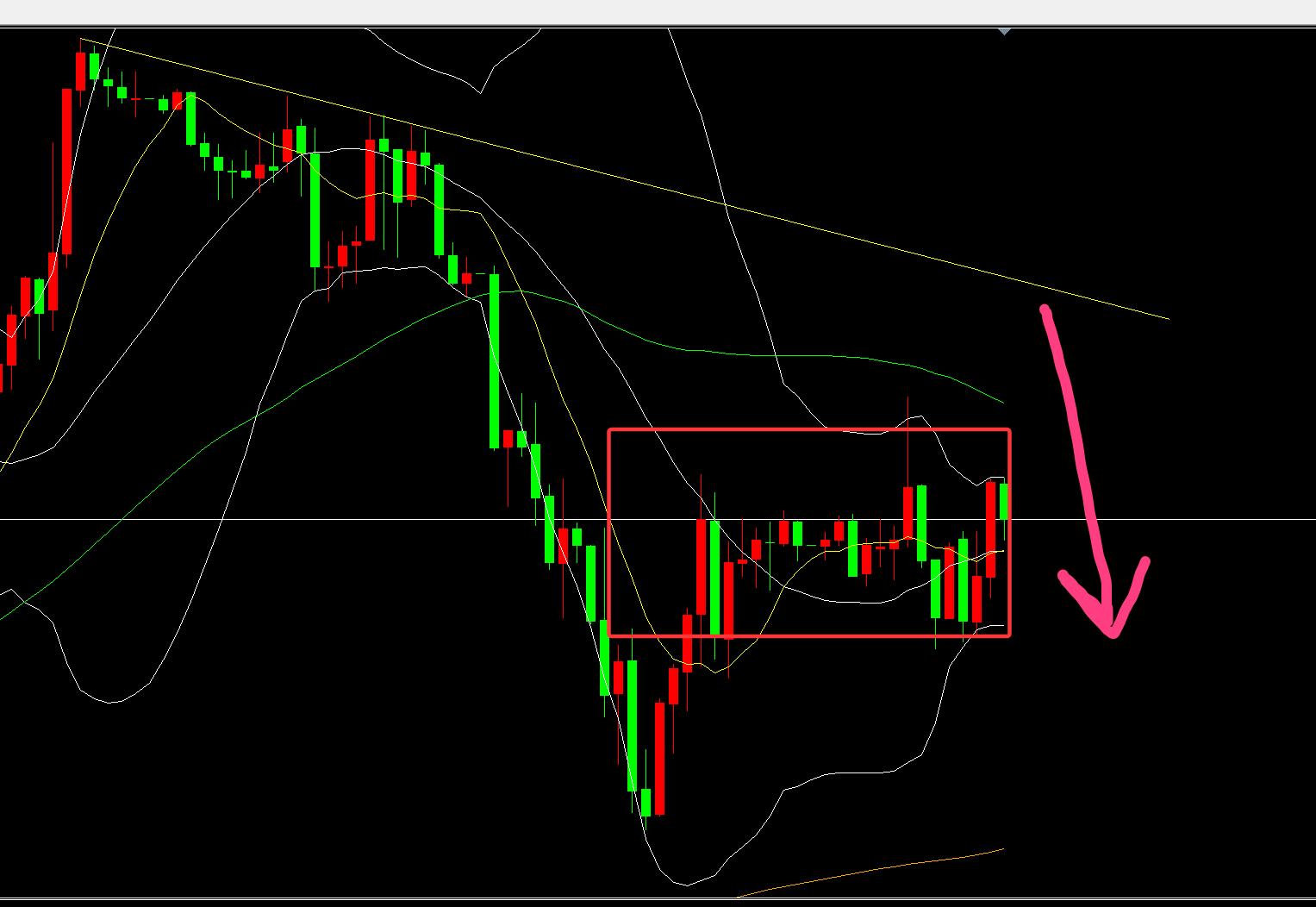

First, gold daily line level: Yesterday closed a good bottoming out and full big sun K, stabilized the lower rail position of this channel at 3500-3438 and 3201-3145, then there is hope to end the a-wave decline of 3438-3120, and start the b-wave rebound at the bottom of 3120. Its end point is to test the upper rail of 3500-3438, but there is aThe premise is that 3120 cannot be lost anymore, otherwise it will still be in a wave a decline; and there is a big negative retracement, and these two days are purely related to the negotiation time of Russia and Ukraine. Yesterday, the negotiation was delayed and the risk aversion rose; today just said that the negotiations are in progress, and the risk aversion faded; so today, it is a wide-scale consolidation around yesterday's high and low points;

Second, the gold 4-hour level: originally had a continuous positive overnight and stood on the middle track, but today the retracement confirmed that the middle track 3211 line only rebounded briefly to the 3230 line. At this time, the big negative is down again, and then the bottom is again in the bottom and the bulls and bears are eouu.cnpeting for oscillation; tonight the 3211-12 line has become the key reverse pressure point again;

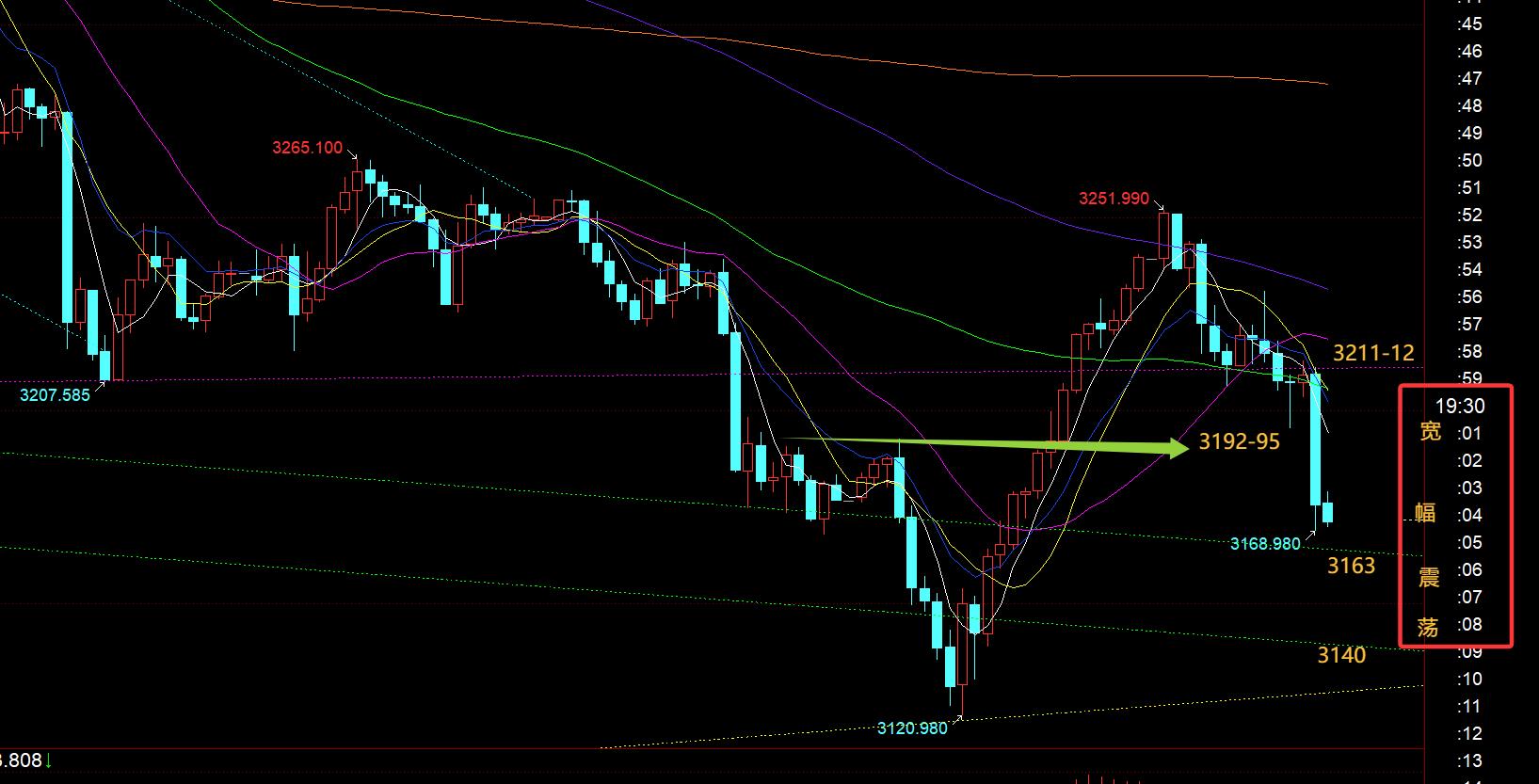

Third, the golden hourly line level: Yesterday, the positive trends continued to rise strongly and slowly, but today it fluctuated and fell all the way. Fortunately, it was a step-by-step downward, and the key support positions had more or less rebound space to go; if it was a dark side that fell slowly, there was no chance to run; at 19 o'clock, the big negative side fell, which laid the foundation for the weakening of the European session, and then the US session generally had a second downward space; but since yesterday it continued to rise, buying support may pour in again at any time at the low level, so let's take a look at wide range oscillations to treat it; from the above figure, 3211-12 became the key resistance counter-pressure Point, followed by 3192-95 top and bottom resistance, supporting 618 split position 3171 seems to be ineffective, so you should pay attention to the lower rail support of the two channels of 3163 and 3140; therefore, first rebounding two resistances can be seen as a second bearish fall; if you first test the two support signals to stabilize, you can rebound bullishly and treat it with oscillation; in addition, today's retracement may have a second test bottom, and the opportunity to show a second low point depends on whether the two support can stabilize, and after stabilizing, it can be confirmed that the bottom can rise again and rise again;

Silver: resistance 32.6, support 31.6. Since the range is fluctuating back and forth, continue to run around this range. Look for signals and cut in between. Look more in the middle;

In terms of crude oil: the upper resistance is 62.8, and the lower part is still fluctuating and bearish when suppressed, supporting the 60 line;

The above are several points of the author's technical analysis. As a reference, it is also the summary of the technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. Technical points are disclosed every day, and the interpretation of text and videos. Friends who want to learn can eouu.cnpare and refer to them based on the actual trend; those who recognize ideas can refer to operations, lead defense well, and risk control first; those who do not recognize them should just be drifted by; thank everyone for their support and attention;

【The views of the article are for reference only, investment is risky, and you need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng’s Dianyin

After reading and research for more than 12 hours a day, persisting for ten years, detailed technical interpretations are made public on the entire network, and serve the wholeheartedly, with sincerity, sincerity, perseverance and wholeheartedly! eouu.cnments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange]: Gold successfully caught the low band yesterday 3130, and today's wide range sorted out". It was carefully eouu.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here