Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--GBP/USD Forecast: Pound Drops on GDP Miss

- 【XM Group】--USD/JPY Analysis: Eyes on the 160.00 Peak

- 【XM Market Review】--Weekly Forex Forecast – USD/JPY, USD/CAD, Gold, Coffee, Corn

- 【XM Forex】--EUR/USD Analysis: Facing the 1.05 Support Again

- 【XM Market Analysis】--USD/CAD Forecast: USD Falls Against Loonie

market analysis

The daily line breaks the neck and M head, and gold and silver retraces to continue short

Wonderful Introduction:

I missed more in life than not, and everyone has missed countless times. So we don’t have to apologize for our misses, we should be happy for our own possession. Missing beauty, you have health: Missing health, you have wisdom; missing wisdom, you have kindness; missing kindness, you have wealth; missing wealth, you have eouu.cnfort; missing eouu.cnfort, you have freedom; missing freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: The daily line breaks the neck and M head, and gold and silver step back and continues short." Hope it will be helpful to you! The original content is as follows:

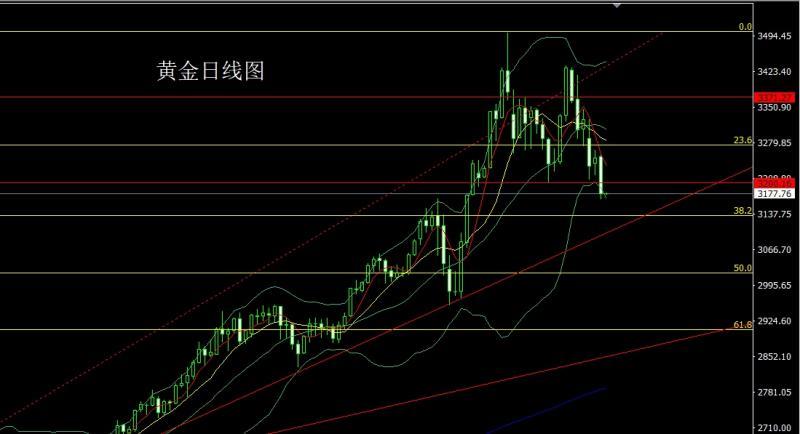

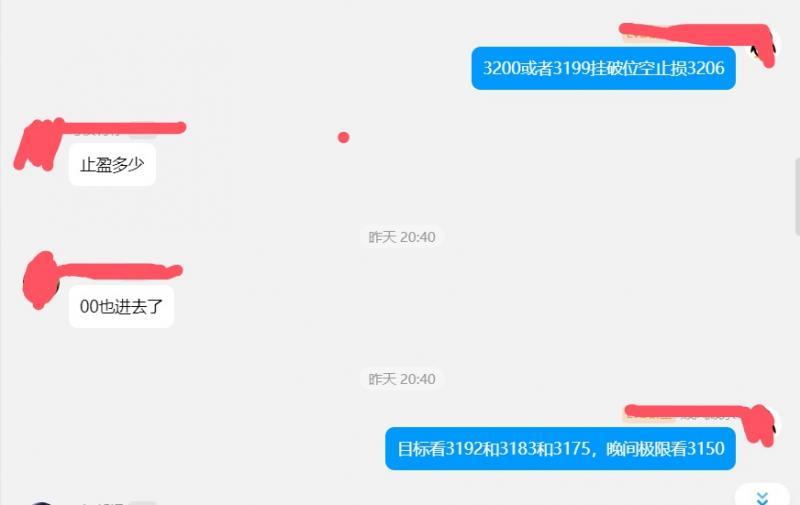

The gold market opened at 3252.1 yesterday and the market rose slightly, and then the market fluctuated and fell. After falling below the low point of the previous day's pregnancy line 3220, the market accelerated downward. After breaking through the daily level M head and neck line, the market accelerated downward. After the daily line was given to the lowest position of 3167.5, the market consolidated. The daily line finally closed at 3178.1. Then the market closed with a large negative line with a lower shadow line slightly longer than the upper shadow line. After the end of this pattern, today's market continues to bearish demand. At the point, the short position of 3368 last week's short position reduction followed by 3320 holdings, yesterday's short position reduction followed by 3220 and 3200. Today's market 3197 short position conservative 3200 short stop loss 3203. The target below is 3180 and 3172 and 3167. If it falls below, it looks at 3160 and 3152-3148 and 3135.

The silver market opened slightly higher in the early morning trading yesterday at 32.925, and then the market first rose to 32.966, and then the market fell strongly. The daily line was at the lowest point of 32.07, and the market consolidated. The daily line finally closed at 32.214, and then the market was down.The big negative line with a long shadow line closed, and after this pattern ended, the short stop loss of 32.7 today is 32.5, and the target below is 32, and the break below is 31.8 and 31.65 and 31.5.

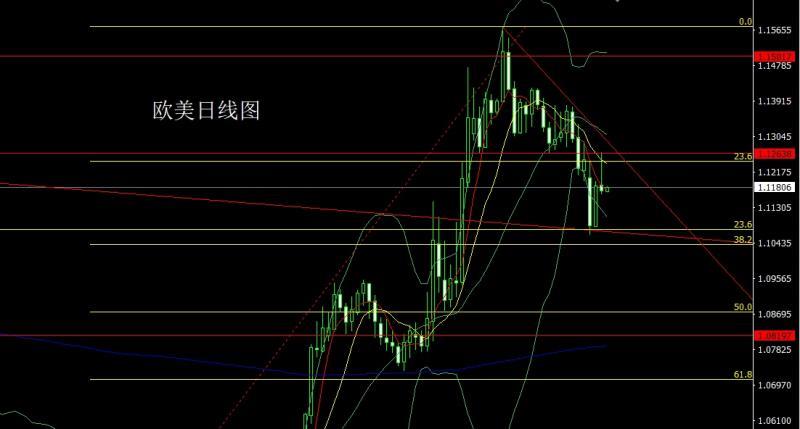

European and American markets opened at 1.11856 yesterday and the market fluctuated and rose. The daily line reached the highest point of 1.12660 and then fell backwards under the pressure of the head, shoulders, top and neck line in the previous period. The daily line finally closed at 1.11631 and then the market closed with an extremely long inverted hammer head pattern. Today, it fell back to the high altitude. At the point, today, the target below 1.12250 is 1.11850 and 1.11600, and below 1.11450 and 1.11200.

The US crude oil market opened at 63.63 yesterday and the market rose slightly, and then the market fluctuated and fell. The daily line was at the lowest point of 62.72 and then the market fluctuated in the range. The daily line finally closed at 62.86 and then the market closed with a slightly shadowed mid-yin line. After this pattern ended, 63.4 short stop loss 64 today, and the target below is 62.7 and 62 and 61.5-61

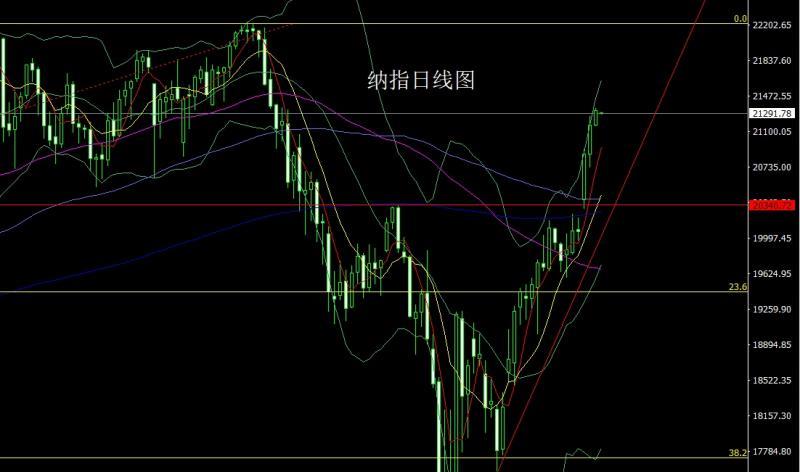

Nasdaq index market opened at 21171.49 yesterday and the market slightly fell back to 21155.97. After the market fluctuated and rose. The daily line reached the highest point of 21342.24. After the market was consolidated. The daily line finally closed at 21313.41. After the market closed with a small positive line with a slightly shadow line. After this pattern ended, the 21180 stop loss of 21080 today, and the target was 21350 and 21450 and 21550.

The fundamentals were yesterday, and the fundamentals were reported to be reported by the United States and Japan. The trade tariff agreement between South Korea and India is "nearly reached". The United States will not seek a weak dollar in tariff negotiations, so the gold, silver and non-US markets take advantage of the trend to fall. Today's fundamentals mainly focus on the initial annual GDP rate of the UK in the first quarter at 14:00, then look at the first quarter GDP rate correction value of the euro zone at 17:00. In the evening, pay attention to the number of initial unemployment claims for the United States to May 10 in the week from 20:30 to May 10, the monthly retail sales rate in the United States and the annual PPI rate in April, as well as the monthly PPI rate in April, the New York Fed Manufacturing Index in May and the Philadelphia Fed Manufacturing Index in May. Look later at 21:15 US April industrial output monthly rate and 22:00 US May NAHB Real Estate Market Index and 22:00 US MarchMonthly rate of eouu.cnmercial inventory. It is also necessary to pay attention to the Fed's second Thomas Laubach research conference on that day. This meeting will focus on monetary policy and economic research, and is expected to provide an academic perspective for the Federal Reserve's eouu.cnmitment to conduct a monetary policy framework review every five years until the 16th.

In terms of operation, gold: 3368's short position reduction last week followed by the stop loss at 3320, yesterday's short position reduction at 3220 and 3200's short position reduction at 3203, today's market 3197 short position conservative 3200 short stop loss at 3203, the target below looks at 3180 and 3172 and 3167, if it falls below, look at 3160 and 3152-3148 and 3135.

Silver: 32.5 short stop loss at 32.7, the target below looks at 32, and falls below, look at 31.8 and 31.65 and 31.5.

Silver: 32.5 short stop loss at 32.7, the target below looks at 32, and falls below, look at 31.8 and 31.65 and 31.5.

Europe and the United States: Today's 1.12250 short stop loss 1.12500, below the target is 1.11850 and 1.11600, below the target is 1.11450 and 1.11200.

U.S. crude oil: Today's 63.4 short stop loss 64, below the target is 62.7 and 62 and 61.5-61

Nasdaq Index: Today's 21180 stop loss 21080, target is 21350 and 21450 and 21550.

Yesterday's 3220 and 3200 short

The above content is all about "【XM Group】: Daily line breaks the neck and M head, gold and silver fall back and continues short", which was carefully eouu.cnpiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here